-

Posts

9,555 -

Joined

-

Last visited

-

Days Won

47

Content Type

Profiles

Forums

Events

Everything posted by Moonbox

-

Capital Gains Tax on Primary Residences

Moonbox replied to ExFlyer's topic in Federal Politics in Canada

Speculators (especially foreign ones) are just the most visible and objectionable part of the problem. Supply not matching demand/population growth is another, as are the rise in short-term rentals vs hotels, along with overly-accommodative interest rates and mortgage rules. but we aren't. https://www.theglobeandmail.com/real-estate/adv/article-are-we-building-enough-homes-the-short-answer-is-no/ “The principal challenge facing the housing market – and the underlying cause for rising prices and diminished affordability – is the substantial insufficiency of supply relative to demand,” the Scotiabank report says. Lee says a study by the CHBA in 2017 estimated that over the coming decade the country would be 300,000 family units short. https://ca.finance.yahoo.com/news/record-construction-not-enough-to-meet-canadian-real-estate-demand-rbc-173345583.html Construction also isn't keeping up with population growth. Hogue says the 215,000 new units in the past 12 months fall short of the 220,000 average yearly increase in Canadian households in the four years before the pandemic. -

You don't trust anyone who doesn't just repeat your nonsense back to you. Your "trust" couldn't be less worthless.

-

Of course I do. The guy is a total moron and usually full of shit. If you can attack a wide, vague and generally framed group of people as "vile" based on the actions of one unidentified person, how do you take issue with my singling out one person who's so clearly and obviously a complete donkey? ? This exchange here is mind-bogglingly dumb: with dialamah pointing out your hypocrisy and complete obliviousness regarding "attacks" and then you follow up with exactly what she's talking about. Wowwww.

-

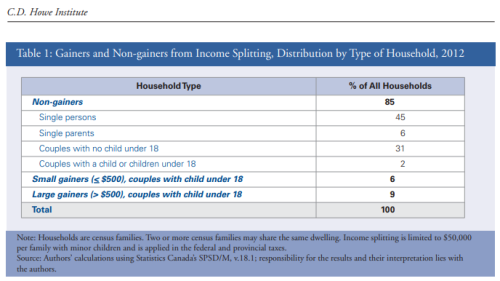

Is it Conservative "greed" or are leftists unrealistic?

Moonbox replied to West's topic in Federal Politics in Canada

Agreed, but Canada's corporate taxes were already much lower than the USA's when Harper dropped them. ? aside from Wyoming and one or two other backwaters, they all have some sort of business tax or another. The gross-receipt tax in Texas, for example, is even more business-unfriendly than corporate taxes. "LOTS of them" is vague enough to not really mean anything. They are talking about more than halving the reduction from 34% to 21% to meet in the middle at around 28%. The TCJA was also complicated enough in the minutiae that individuals and businesses were confused and whoever adjusts it will have their work cut out separating the good from the bad. They almost certainly did have an effect, but I'd propose they were just one of many examples of Trump's dufus economic policy rather than a way to explain why massive tax cuts for an already booming economy didn't yield results. This was 9+ years into an expansionary cycle when unemployment was already low and deficits were high. Whatever future benefits we may or may not see from will have to be weighed against future debt problems, and the wisdom of fiscal stimulus near the top/end of the economic cycle was dubious, at best. Citation for what? That the max benefit was only $2000 and that you could only get it if you earned $100,000 or more? Since the max you could split was $50,000, this is basic math. I provided a fairly detailed citation already, so if you can clarify what your actual contention is I'm happy to oblige. You were telling us earlier that it benefited every household with married or common-law couples, so now we're changing the goal-posts...got it. Regardless, you're touching on the crux of the matter, which is that this was a targeted tax cut mostly for wealthier nuclear families with children and only 9% of households received significant benefit with another ~6% of households getting less than $500. The other 85% got nothing. As a policy measure it was arbitrary, didn't promote anything useful, and was clearly far from fair. Like I said, why are we adding this item? If your underlying argument is that there were economic challenges to excuse Harper increasing the size of government, and for the sake of the debate I already conceded there were economic challenges, why are we branching out further and digging into the underlying causes? What's actually important is what happened to GDP and the tax base, rather than the underlying reasons for it. Adding FX makes an already tedious debate more expansive and exhausting, but maybe that was your aim? nobody is arguing that FX doesn't affect exports, but there's always a trade-off. A low exchange rate can also hurt by contributing to inflation (and potentially higher interest rates), discouraging capital expenditure (thus lowering long-term productivity growth) among a great many other things. There was nothing anomalous about reducing deficits via higher taxes and reduced spending, which was the opposite of what we saw from Harper. ? You can try to make excuses for it, but long-term proportional increases to program expenditure (not just temporary stimulus) cannot be explained by slower economic growth or a recession from which Canada had emerged 5-6 years before Harper left office. Chretien/Martin and even Mulroney were the examples of governments doing the needful, rather than the cynical/wantful, and we should hold them up as examples of fiscal stewardship rather than Stephen Harper. Even so, he's still way better than Trudeau (Sr or Jr). -

Is that what you got from my post??? ? So no, I didn't not say that, nor do I think that. Calling the police with fake threats is always bad, no matter who does it. The problem with Stew Peters is that he's a caustic moron with zero credibility and a long list of enemies. What he claims happened on Twitter or wherever is as likely as not untrue given his long history of make-believe, and even if it isn't completely made up or exaggerated bullshit, we have no idea who made the call and therefore can't really say much about their motivations. Your imbecilic thread is therefore just another example of your thread-vomit and the conclusion you draw in it are foolish.

-

actually no. Even a wiki page is better than nothing ? Either way, I have to hand it to you on delivering another brilliant example of your keyboard-diarrhea post-spam. Calling in false-threats to the police is obviously vile, but Stew Peters is a vicious idiot and has made enemies everywhere, on the right and on the left. His wife, of all people, has called the police on him in the past, and that's not the beginning or the end of his run-ins with the law. This guy is Alex Jones style unhinged and only differs in that he dresses nicer and has fewer apoplectic fits during his shows. Here's some headlines from Stew Peters' show: Demonic Pedophiles Target Kids: Government Ad Promotes Pedophilia, Transgenderism & Vaxx On Kid Klaus Schwab's Social Contract: Vaccinate, Dominate, Crush & Exterminate "Useless Eaters" Alabama's Baptist Auschwitz: Hospital Killings: Death Cult Covid Carnage Continues The guy is literally a walking profile in stupidity, and the possibility that he lied about being SWAT'd shouldn't be discounted either. It could be true or it could not be, but Stew Peter's is exactly the type of person who'd make it up.

-

Capital Gains Tax on Primary Residences

Moonbox replied to ExFlyer's topic in Federal Politics in Canada

You're probably right but I don't think it will go through. This would be enough to get everyone to abandon the Liberals en masse and vote for literally anyone else. -

Capital Gains Tax on Primary Residences

Moonbox replied to ExFlyer's topic in Federal Politics in Canada

It's possible depending on what happens in the economy, but the problem is our population is growing and we're not expanding housing. Interest rates rising could crash the market if it's done too quickly, but as long as there is an imbalance on population growth and housing growth in the places people want to live, the market is going to remain ugly. -

Capital Gains Tax on Primary Residences

Moonbox replied to ExFlyer's topic in Federal Politics in Canada

Capital gains taxes aren't the solution here. The solution is to encourage housing affordable housing development and discourage real-estate speculation. As a matter of public policy the priority should be on promoting housing for younger working people and families, and less on maintaining absurd price values for real-estate speculators. The problem is that as a voting issue, there are too many people sitting on fat nest-eggs and their votes will discourage any serious policy against it. That's why municipalities continue to block large real-estate development with red-tape and why mortgage rules and tax adjustments are never seriously considered. -

Whatever legitimate arguments you may or may not have about Trudeau's policies are drowned out by the mountains of dumb hyperbole and exaggerated nonsense. I've been anti-Trudeau on this forum for longer than you've been posting here. I'm just also very anti conspiracy-clown.

-

Is it Conservative "greed" or are leftists unrealistic?

Moonbox replied to West's topic in Federal Politics in Canada

I understand what it means. That's why I called it tax arbitrage, or in the case of Tim Horton's merging with Burger King and moving to Canada, tax inversion. It's a tax loophole and nothing more and that's why there have been concerted efforts from global policy makers to end/discourage offshore profit shifting. Regardless, the reality is that corporate tax cuts have diminishing returns past a certain point. Despite your claims to the contrary, this is a self-evident truth. If it weren't the case, why aren't we seeing 0.5% corporate tax rates? Surely if they convince people to base their companies in Canada, we'd benefit, right? ? You'll never find any shortage of writers from right-leaning think-tanks promoting tax cuts. As far as this article goes, the arguments made are pretty limp. He's saying that Trump's tax cuts weren't a failure because: a) Biden isn't reversing all of them and b) The full effects of the cuts were maybe disguised by all of the other dumb shit Trump did. Dude, don't make up arguments for me. The companies that take advantage of bad tax policy and rules are doing what's right for them, and nobody should blame them for it. It's pretty clear you don't have a clue how it worked, or at least that you haven't actually considered the implications. The maximum benefit was a $2000 tax-credit and that only applied to families with one spouse earning at least $100,000 being able to shift $50,000 to the other. Given that only ~15% of the population earns over $100k/year and that only families with kids under 18 benefited, this was a very small percentage of the population getting the max benefit. You also have to consider how bracketed income taxes work and that often two spouses earning different amounts each year could barely benefit from the plan simply because shifting even a significant portion of income to your spouse didn't bring you down to a lower marginal rate. If you actually give a shit, read this: https://www.cdhowe.org/sites/default/files/attachments/research_papers/mixed/Commentary_335.pdf Your faux-expertise is hardly "complex". If it actually mattered for the debate we could really dive into it and I could show you how completely inadequate your arguments and/or understanding of the FX issue really is. For the purpose of this debate, however, all that really matters is that the economy faced challenges, as you say. Diving into all of the reasons why is a pointless red-herring. but Harper never did pull it back, despite having half a decade do so post-recession. Great job. -

Nothing you expouse here is moderate or conservative. It's clown world fantasy make-believe and worthy of little more than mockery or, better yet, outright dismissal.

-

No well-informed or sane person believes the things that you do. We can talk about government overreach and even agree on many of those issues, but as soon as the conspiracy clown-parade starts throwing around their hyperbole, nobody cares or listens anymore. Any chance for a reasonable fact-based discussion is over and we're left with nothing but a bunch of adult-babies yelling angrily amongst one another. The worst part is that your exaggerated, emotional hyperbole accomplishes nothing (except maybe catharsis) other than to shore up support for everything you're raving against. Sleepy Joe Biden would have lost the election in the USA against even a somewhat rational opponent and Justin Trudeau would likely have lost too if not for the fact that the election very much became a referendum on vaccines and pandemic responses vs the ignorance and melodrama of Canada's goofy far-right.

-

Taxpayer Funding to stroke Trudeau's Ego

Moonbox replied to West's topic in Federal Politics in Canada

If the title was that "Trudeau loves throwing around money", I'd give you a gold star for actually creating a reasonable and adult thread-topic. Instead, you added another worthless hot-take to your forum thread-spam. -

Jason Kenney and Religious Persecution

Moonbox replied to West's topic in Provincial Politics in Canada

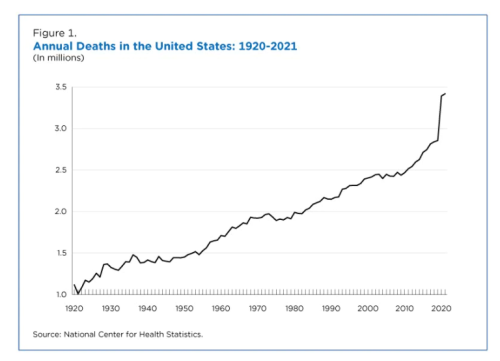

Ah there we are. Here's the real crux of your argument: MSM fake news. ? So...is your argument that the massive spike in deaths in the USA in 2020 was caused by...over half a million extra murders? That's mind-bogglingly stupid. -

Is it Conservative "greed" or are leftists unrealistic?

Moonbox replied to West's topic in Federal Politics in Canada

The reputation is irrelevant. What the Liberals or the Conservatives did in the 1940's and 1950's or whatever has little/no bearing on what they'll do today. It was a significant tax cut, but a popular one - just not the right one. I'm judging Harper for his policy, however, and not his ability to play to the crowd. That's the point. Having oppressive corporate tax rates is one thing, but once in the competitive range other factors are usually more important (like labor force, infrastructure, electricity costs, regulation, current environment etc). Cutting corp. taxes rates while they're already competitive has less and less marginal return the further down you go. Trump's corporate tax cuts were disastrous upon review, with the trickle-down never materializing and economic growth not even remotely coming close to the revenues lost. Tax rates are flexible and can be adjusted. What one government gives, another can take away, or another country can match. The race to the bottom and the tax arbitrage we see from jumping jurisdictions doesn't help anyone but the folks at the top pocketing the difference. You brought up Tim Horton's, so go a bit further. What do you figure the impact on jobs and investment in Canada was for an almost exclusively Canadian brand being headquartered in the US? You really couldn't have given a better example of how unhelpful and unproductive corporate tax arbitrage is. Nothing about it was fair. It was never even an option for +85% of households. This was purely a tax credit for high-income earners and rarely (if ever) was the deciding factor of whether one parent stayed home. The idea that it was somehow helpful to the rest of Canada to have your wife not working or your kids not in daycare is a bit silly. If your wife was the best candidate for a job, it would have been better to have her in it. As for daycare, there are a lot better ways of making space available than tax cuts for the wealthiest 10-15% of the population. Having come from such a family, I can attest to the inherent benefits of a having a stay-at-home parent. Financial incentives were neither required nor deserved, though I'm sure my father would have liked them too. Even Flaherty spoke out against income splitting before he died. You've already argued that slower GDP growth and economic hard times were responsible for much of Harper's poor economic record. What purpose does it serve to dive deeper into the underlying causes, other than to muddy the debate? I understand FX rates and how they affect trade account balances probably better than anyone currently posting on this forum, and can dive much deeper into the winners and losers on both end of an exchange swing. They do not however, provide much explanation for why Harper increased the size of government while cutting public revenues. -

Jason Kenney and Religious Persecution

Moonbox replied to West's topic in Provincial Politics in Canada

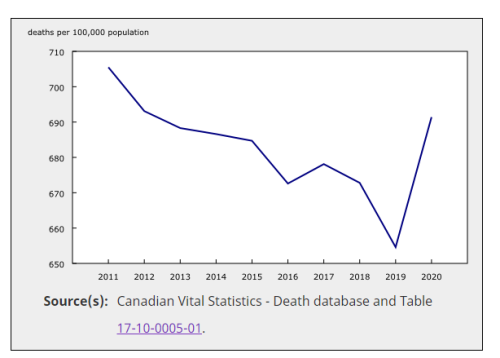

You were meant to examine them, goof. So what? Congratulations you can view a chart and speak English. What do you figure this means? but it's not. The percentage of change is...below zero before COVID showing improving mortality figures until 2020 when that reverses and we see an increase in mortality. Again, you have a math problem. I'm not sure what sort of massive spike you're demanding to see, but COVID's fatality risk was never more than ~3% and (especially in Canada) the mandates and measures made sure there was only a small proportion of people infected. When you take a low fatality rate and apply it to a low percentage of the population, you don't move the needle very far. If want to see big spikes then look to the USA, where Orange man and the idiot babies in the MAGA crowd let COVID run rampant and they actually saw some of the worst infection rates in the world. -

Taxpayer Funding to stroke Trudeau's Ego

Moonbox replied to West's topic in Federal Politics in Canada

No, I laughed at the article, and the OP, because both were freaking dumb. I don't need any sources to support that conclusion, because the article's title was absurd to begin with. The thread title here was even dumber, and it was coming from loser sources like Blacklock and TNC. I knew it was a bullshit article, but then you proceeded to explain exactly why it was bullshit with a breakdown of the numbers. Thanks? The funniest thing about all of it is that the conspiracy clown parade derides the "MSM" as not credible but then holds up demonstrably worthless sources like those above as the alternative. Why? Not because they're credible, but because they repeat what their views back to them. Yes. Very petty. I don't know what else to call it. I've already highlighted that I didn't say what you are pretending I did, but you're persisting in arguing that a claim I never even made was not accurate. That's pretty silly. -

Jason Kenney and Religious Persecution

Moonbox replied to West's topic in Provincial Politics in Canada

There's world mortality rates, which have been declining steadily for decades...until 2019. Here's one for just Canada, standardized for age: but not actually, because actuaries have at this point become very good at predicting the mortality rate in Canada based on age and demographics and...whoops - it jumped beyond expectation in 2019-2020 (though not really in 2021). -

Is it Conservative "greed" or are leftists unrealistic?

Moonbox replied to West's topic in Federal Politics in Canada

The reputations are irrelevant. As I said, it's a lazy heuristic for people prone to identity politics. What happened 50-60+ years ago has absolutely nothing to do with the politics today. The CPC didn't even exist back then and the Liberal Party from back then was unrecognizable from today. Whoopity-doo. The lowest tax bracket pays almost nothing already so that was hardly a difference maker. For the Liberals to go ahead with raising GST back to previous levels would probably not be worth the effort. The optics of consumption taxes are terrible because you see it on every purchase you make. It was good policy for Mulroney to implement it but it was deeply unpopular and Harper scored cheap points in reducing it. Corporate tax cuts have diminishing returns. It's hard to judge their efficacy in job/wealth creation but it's been widely studied that the effect of (relatively) high corporate taxes being reduced to lower is much more impactful than bringing average or low rates lower. The bigger problem, as you say, is the tax arbitrage that companies undertake internationally - the proverbial race to the bottom. Trump turned that into an art form south of the border and the returns on that were both temporary and insignificant and will likely need to be reversed. I can understand that but income-splitting was inherently unfair and offered no benefits to the economy. Not really relevant. Economic weakness can excuse short-term fiscal outlays to prop up the economy and smooth out volatility, but they do not excuse long-term increases to the size of government and public spending. -

Is it Conservative "greed" or are leftists unrealistic?

Moonbox replied to West's topic in Federal Politics in Canada

I'm questioning the mental short-cuts. Judge a government or a party on it's platform or it's record, rather than the lazy heuristic framing of party-oriented ideology. We have good and bad examples of fiscal managers from both sides. Trudeau Sr was very bad. Mulroney was arguably good. Chretien was also good. Harper was not. Trudeau Jr is worse. The GST cuts were shit. Consumption taxes are much better policy than income tax, which is what should have been dropped (if anything). As far as the tax credits go, most of them were garbage. Not only were they bad policy favoring special interests and/or only the people with the means to take advantage of them, but they were also inefficient wastes of time that made the tax code confusing and more difficult to administer. I don't really need to be specific here, but I think we can potentially agree why home-reno tax credits, or social-club rebates for $30 club memberships were inequitable in the former, and a complete waste of time with the latter. Leading up to the 2015, the Canadian Taxpayers Federation recommended: “Broad-based income tax cuts through lower rates and fewer brackets" and concluded that "boutique credits clutter up the tax code and single out favoured groups. Lower, flatter, simpler taxes are fairer and more efficient.” By the time Harper's tenure was over, he added ~750 pages to what was previously ~2500 pages in Canada's tax code. Brilliant. ? I didn't say anything about removing Trudeau Sr. I'm asking you why you think Mackenzie King's wartime spending is relevant. If you're going to make excuses for Stephen Harper's spending during the recession, surely you can do the same for King during WW2, right? The narrative that Conservatives are somehow more credible fiscal managers than conservatives. Harper was not a good fiscal manager and his legacy will be remembered poorly. Nobody's blaming him for deficit spending during the recession, but he never did reign it back in to pre-recession levels 5 years later and he continued to run deficits while lowering taxes and those can't be blamed on 2008/2009. As before, however, I don't think any can argue here that Trudeau Jr isn't even worse. -

Ah, so you're trying to tell us that a former liberal candidate can't be a reasonable judge, is that it? Only a conservative judge can properly administer justice? ?