-

Posts

1,472 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by godzilla

-

he is doing it again. he said so. he's extending the Trump tax cuts. i supplied you with citations that provided that there was no economic advantage in the first year of the tax cuts. you said that COVID distorting things for the next year so i gave you that. there is no proof that those tax cuts generated any economic benefit. if there is then you should cite it. and you're wrong about the last point. when tax cuts are provided and the government has to borrow to cover costs then the interest on that is a cost. its also a debt that has to be paid later. possibly by an even more regressive tax regime. Trump added 8 trillion to the national debt in his first term.

-

here's my whole post that you didn't read i guess over again... How income inequality threatens democracy Wealth inequality, democracy and economic freedom "Wealth inequality significantly hampers economic freedom and this effect is reinforced at a lower level of democracy." Inequality Spurs Democratic Backsliding How Inequality Undermines Democracy Support for Democracy in the Age of Rising Inequality and Population Aging i could go on all day. and for the contrarian view... since you guys love the Koch Institute... i mean, the Cato Institute. Has Wealth Inequality Eroded U.S. Democracy? "In short, the evidence for wealth inequality leading to democratic capture is extraordinarily thin." hmm... well maybe not so contrarian. they just said it was "thin". but more importantly... from the Harvard Business Review Income Inequality Makes Whole Countries Less Happy

-

jeesh. we started talking about the class source of the nouveau riche because you simply stated "everyone" can become rich if they tried hard enough. you failed to comment at all on the "success paradox". it wasn't part of my original post at all. wasn't sure why you brought it up. but now you're making a connection between the rich coming more from the middle class and the poor and Trumps tax cuts? thats a stretch. the article seemed to imply that the shift has been happening since the 1960's. wealth inequality is not a problem. you stick with that. no need to read all the citations i supply. i mean, if what you mean is that its not a problem "at the moment" or in relation to Trumps economic policies... then thats maybe an argument that you can make. but the general argument that "wealth inequality is not a problem" doesn't hold water in economic circles. just take it to the extreme. one guy has all the money. no problem?

-

chill out man. no one is lying. i provided the citation on the $10T number. here it is again. Trump’s Tax Cut-A-Rama Total So Far: $9.75 Trillion if you have another number then please submit it. yes, the implied premise that regressive taxation that favors the rich when wealth distribution inequality is at an all time high was what others brought up in response. that if Trump tax cuts favor the rich and it doesn't matter. you and others challenged the premise.

-

Trump says down with windmills. I agree. They are ugly.

godzilla replied to blackbird's topic in Federal Politics in Canada

can't wait to get rid of windmills, solar panels... all the "green stuff"! then we can get back to burning good old coal! Mountains of unused coal causing financial headaches for US power sector: Report i mean, the respirator illnesses we are missing out on! -

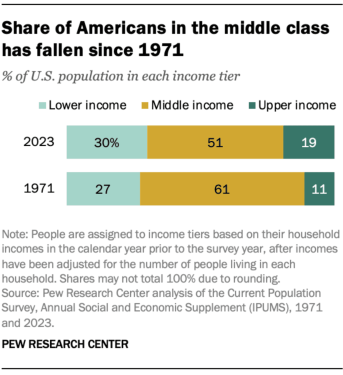

did you purposely leave out the word "upper" from the above statement? the "upper middle" class? "who didn't grow up wealthy but had some money in the family—the equivalent of the upper middle class" "The upper middle class in the United States is generally defined as a household income of $94,001–$153,000, according to the Census Bureau." more people became upper income than lower income! thats good news... i think. of course, everyones not going to be able to be rich so... maybe its going to be just rich people and poor people?

-

How income inequality threatens democracy Wealth inequality, democracy and economic freedom "Wealth inequality significantly hampers economic freedom and this effect is reinforced at a lower level of democracy." Inequality Spurs Democratic Backsliding How Inequality Undermines Democracy Support for Democracy in the Age of Rising Inequality and Population Aging i could go on all day. and for the contrarian view... since you guys love the Koch Institute... i mean, the Cato Institute. Has Wealth Inequality Eroded U.S. Democracy? "In short, the evidence for wealth inequality leading to democratic capture is extraordinarily thin." hmm... well maybe not so contrarian. they just said it was "thin". but more importantly... from the Harvard Business Review Income Inequality Makes Whole Countries Less Happy but hey! Trumps tax cuts are NOT making the rich more rich! its just putting more money in their pockets than poor people! like, who make too little to pay taxes in the first place... whatever.

-

"can"? that means that there is not zero probability... so is your argument that everyone in the US of any socioeconomic class has the same probability of becoming wealthy? because, the wealth distribution would say otherwise. or is that the same old trope that they just don't try hard enough? still waiting for a number from you regarding how much the Trump tax removed from government revenues! ok ok.. i'm slowing down. taking a breadth. "even if the numbers are correct..." means that "there are numbers". where did the numbers come from?

-

HAHAHAHAHA! so EVERYONE can be wealthy? hahahaha! i'm afraid thats not how it works, friend. if everyone was wealthy then a loaf of bread would be $1000. inflation would adjust all the classes back to where they were. i've done very well but others in my field have knocked it out of the park and others less well than i. and we were all doing the very same thing. its just that some had more luck than others. in fact, its statistically calculable that these things are luck. and its statistically calculable that once you have big money that it makes money on its own and that you don't even have to try any more. its the success paradox. Is Success Luck or Hard Work?

-

is that it? thats all you got? a Hill "opinion piece" by Justin Haskins of the Heartland Institute? quoting his one pager at the Heartland Institute website where he supplies data with no citations to anything published by the IRS? even if those numbers are correct... inflation of 8% destroys any middle class and lower advantage. when eggs double in price for the lower half then its serious. for the upper middle half its... meh. i'm not a Trump bad guy... he's an id!ot and an obvious tyrant. whatever. i'm making a factual claim that "conservative" policies favour regressive tax regimes while "liberal" policies favour progressive tax regimes. thats a fact. thats the whole nature of the beast of politics. the Trump tax cuts weaken progressive tax regimes. in times where the economy is on steroids, the inequality of the wealth distribution is at an all time high, inflation has spiked the cost of living and there has been little to no rise in wages of the working... then the outcomes are obvious from an economic standpoint. its ridiculous to state otherwise. HAHAHAHAHAHAHAHAA!!!!

-

wow, so much rich worship! let me ask you something. if i had a great business idea and wanted capital to make it work and you invested... then that business made it big, would you expect something in return? does Musk and Bezos make all of this money by themselves, naked in the forest somewhere? or do they manipulate the resources that they have access to to generate that wealth? the latter. they use the roads, bridges, electricity and infrastructure. they rely on the consistency of safety from the military and first responders. they need labour. educated and healthy labour. labour that is also sustained by that same infrastructure. and i won't even start to touch on the fact that being rich is statistically just plain stupid luck. most of it is. so what is it? should working people pay more than the rich? again, everything in politics is one conversation masked as many. who pays for the socialist component of our mixed economy is the only fight that is consistent in ideological politics. and history is pretty clear that the progressive tax system is the most powerful tool at building a very strong society that can maintain a very robust economy. and that concentration of money in fewer hands leads to an oligarch situation. wealth is mobile so the wealthy can always leave. i'm all for the free enterprise component of the mixed economy. but when people are so frickin wealthy that they will never be able to touch or experience even a portion of that wealth then its time to put it to good use. and if poor people get hand outs. then so what? at any moment "society" could decide that they go dodge bullets for "US interests". but whatever... keep worshipping the rich and blaming the poor for all of societies problems.

-

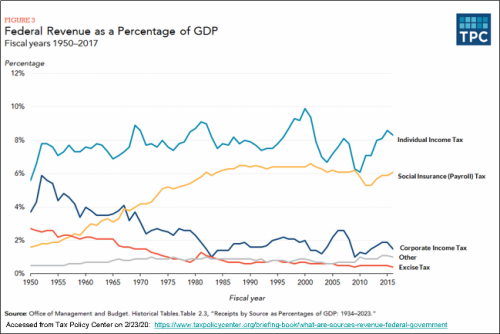

great. i get that. so what is the number? your cite from the Koch family doesn't mention any real data from the outcomes of Trumps tax cuts at all. again, again... this cite from Wikipedia offers 300 citations. Tax Cuts and Jobs Act "According to Bloomberg, the TCJA has simplified the tax code for some, but not others; has lowered corporate debt; has led investment to temporarily increase before declining; and has brought money back from overseas without bringing back business activity." "during the first year following enactment of the TCJA, real median household income increased by $553; the Census Bureau characterized this increase as statistically insignificant." In 2018, companies spent a record-setting $1.1 trillion to buy back their own stock, and a majority of major firms (84%, as polled by the National Association for Business Economics) did not alter their hiring practice or their investment in their business in response to the tax cuts they received. This pattern was evident even in early 2018, when Bloomberg reported (based on an analysis of 51 S&P 500 companies) that an estimated 60% of corporate tax savings was going to shareholders, while 15% was going to employees. A Bloomberg Economics analysis found that, while business investment did increase in 2018, relatively little of that activity could be attributed to lower taxes.[131] A study by the Federal Reserve Bank similarly found that corporations bought-back stock and paid down debt, rather than undertake either new capital expenditure or investment in research & development. Bloomberg News reported in January 2020 that the top six American banks saved more than $32 billion in taxes during the two years after enactment of the tax cut, while they reduced lending, cut jobs and increased distributions to shareholders." "Federal corporate tax receipts fell from an annualized level of $409 billion in Q1 2017 to $269 billion in Q1 2018, a direct result of the Trump tax cuts.[135][136] Corporate tax receipts for the full fiscal year ended September 2018 were down 31% from the prior fiscal year, the largest decline since records began in 1934, except for during the Great Recession when corporate profits, and hence corporate tax receipts, plummeted. Analysts attributed the fiscal 2018 decline to the tax cut" while i can't find a nice graph showing tax revenue over time that goes past 2015, the lines continue on their trajectory. 1.3% of US tax revenue from corporations in 2023. note the rise in payroll tax vs corporate tax. " all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages.[1][2][3][4] Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education." i could go on... the overall view from economists is that this is a tax cut for the rich with no mandate to increase spending in the economy. and tariffs? is that a progressive or regressive tax? its a regressive tax. Trump is indeed "winning"... but thats just him and the billionaire boys club.

-

ah yes... the moral bias. i'm dishonest because i thought that was the right number but now i'm being told it is not. i already admitted that it may not be the number. i haven't even bothered to look. because its too much fun asking you what the number is and having you refuse to supply one! i can be wrong. and i'm always willing to adjust my mental model to accept fact. prove it. give me the number. stop with the cop outs.