reason10

Member-

Posts

4,404 -

Joined

-

Last visited

-

Days Won

5

reason10 last won the day on June 7 2023

reason10 had the most liked content!

Recent Profile Visitors

1,394 profile views

reason10's Achievements

-

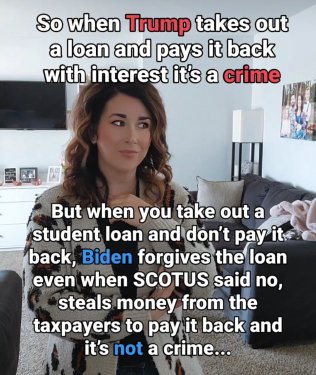

LEGALLY ELECTED PRESIDENT TRUMP as well as private citizen Donald Trump violated no law whatsoever. It is not illegal to make liberals cry.

-

No crime was committed. This trial is part of the Biden Reelection strategy. That pedophile cannot run on his record.

-

Fastest growing states

reason10 replied to impartialobserver's topic in State Politics in the United States

https://www.clickorlando.com/news/florida/2023/07/15/report-florida-ranks-as-best-state-economy-in-the-us/ EPORT: Florida ranks as best state economy in the U.S. https://www.flgov.com/2024/03/11/floridas-economy-continues-to-outpace-the-nation-in-2024/ Florida ’s Economy Continues to Outpace the Nation in 2024 https://myq105.com/2023/08/02/florida-has-the-best-economy-in-america-heres-why/ Florida Has the Best Economy in America – Here’s Why https://floridajobs.org/news-center/DEO-Press/2023/10/23/florida-ranks-1-in-the-nation-for-entrepreneurship Florida Ranks #1 in the Nation for Entrepreneurship https://www.wjhg.com/2022/07/06/florida-surpasses-nation-economic-growth/ Florida surpasses nation in economic growth A lot of different and diverse sources pretty much say the same thing. There are some others that put Florida close to the top, over most blue states. One single chart? Any idi0t can make a chart. I prefer consulting more than one diverse source. -

Anti semitism all the rage on US college campuses

reason10 replied to West's topic in Federal Politics in the United States

Which is the student being "blocked"? I don't see anyone trying to get past the "chain." We didn't see any students being blocked with RACIST DEMOCRAT ALABAMA GOVERNOR WALLACE stood at the registration door of that college campus to prevent blacks from enrolling. Maybe you think the Jewish students should have Star Of David armbands, like your predecessors required of Jews, just before putting them in camps. Hitler, Democrat liberals Same ideology.Same tactics. -

There’s no such thing as a CENTRIST abortion position to a woman who needs an abortion: She can obtain the abortion, or she can’t. That's true. And there is no CENTRIST position for a rapist, a serial murderer, a mugger. He/she can either kill, rape, mug or he/she can't. Here’s an idea: If we can break the abortion decision down to the STATE level, why not make it at the COUNTY level? Better yet… at the TOWN level. WAIT!! I’ve got it! Let’s make the abortion decision at the INDIVIDUAL level. That way, every single person can have their own personal abortion policy. I call it “Freedom and Liberty.” Right now, it's about as good as it is going to get, freedom wise. (And that includes freedom for ALL humans, not just those who have been born.) Again, the total ANTI ABORTION crowd would outlaw the procedure entirely. No abortions for ANY reason. The total PRO ABORTION crowd would require taxpayers to pay for ALL abortions, and they could occur at any time, including an hour after a live birth. The country is kinda split in the middle. The Trump solution is about as in the middle as it is going to get. So, if you don't want a child, don't make a child. Don't engage in the activity that makes babies, unless you have birth control. If you achieve conception, NO STATE will prevent you from ending the conception at that point. Even the state of Mississippi allows abortion exceptions for rape/incest and/or saving the life of the mother. If you are raped, report it to the police. Go to the hospital to get a rape kit, which will help the police to find the animal who did it. Then the doctor will likey give you a morning after pill which will either halt conception or prevent it. That's reasonable. And that's where most of America is right now.

-

Look at the track record. Alleged "pro life" presidents like Reagan and Bush 43 had Republican congresses. (KInd of.) They could have written a LIFE bill that would have outlawed the very practice of abortion. Even as they had appointed Supreme Court justices who actually READ the constitution, the issue came up several times before the Court and was shot down. Right now, LEGALLY ELECTED PRESIDENT TRUMP owns the credit for getting that Nazi law Roe overturned. He appointed three CONSTITUTIONAL judges (Gorsuch, Barrett and Kavanaugh) and Roe is history. Trump has done something NO OTHER REPUBLICAN president could have imagined. Most of America wants the decision to go to the states. If most of America wanted abortion overturned at the federal level, there would have been veto proof Congresses and Republican presidents. If most of America wanted abortion on demand right up to birth (and even an hour afterwards) they would have voted for DemoNazi Congressional majorities and DemoNazi presidents. I'd say FINALLY the people have gotten what they want.

-

You !diot. Trump was a DEMOCRAT back in 1999. He wasn't holding public office. He was contributing to Nazi candidates like Hitlary KKKlinton. He has more principles than ANY Democrat president in the history of America. I know. That isn't saying much. Kinda hard to link Nazis with the term 'principle.'

-

That is a LIE. He has ALWAYS supported sending the decision back to the states. (And your UNELECTED COMMUNIST PEDOPHILE is the KING of pandering.) You NAZIS are the ones who claim overturning Roe was done by a TRUMP Supreme Court (which might have been true had Trump been president for the past 40 years.) He appointed THREE justices who had ACTUALLY read the Constitution and they voted with the majority to overturn Roe. Lack of principles? Out here in the land of REALITY (which you Nazis seem to be physically allergic to) LEGALLY ELECTED PRESIDENT TRUMP is a hero to the pro-life movement, by finally arranging for the overturning of that NAZI Supreme Court decision. Most of America agrees it should go to the states. Only extremist FASCISTS like you want a NAZI government to mandate their FINAL SOLUTION FOR BABIES. Sieg Heil.

-

Trump Backtracks on Abortion Ban

reason10 replied to Rebound's topic in Federal Politics in the United States

That is a LIE. LEGALLY ELECTED PRESIDENT TRUMP has ALWAYS favored sending the baby killing decision back to the states. Roe was BAD LAW. It should have been overturned. It was about as constitutional as Mein Kampf. And if the goose stepping FEMINAZIS on YOUR side of the aisle want baby killing so bad, they've had PLENTY of DemoNazi Congresses and PLENTY of DemoNazi presidents to write the bill and sign it into law. Why haven't they done that yet? Why haven't BABIES become an endangered species yet, Adolf? -

The reporter was obviously a left winger and a LIAR. It's hard for LEGALLY ELECTED PRESIDENT TRUMP to have a crowd that is LESS than 10,000. That's how popular this great president is. That's why most of America do not believe that a racist PEDOPHILE LIAR like Biden, who couldn't draw FIFTY PEOPLE for a rally somehow got more votes than Barak Saddam Hussein Obama. We know the truth. \

-

https://www.foxnews.com/politics/trump-says-abortion-should-be-decided-the-states-will-the-people Trump says abortion should be decided by the states, 'will of the people' Trump vows support for IVF, abortion laws should be decided by the people and the states Former President Trump announced on Monday his position on whether abortion should be banned, following months of not taking a stance on the combustible and crucial issue in his 2024 rematch with President Biden. The presumptive Republican presidential nominee took to his social media platform on Sunday night to say that he would issue a statement on "abortion and abortion rights." In video posted hours later on early Monday morning, Trump explicitly affirmed his support for in vitro fertilization (IVF) and he emphasized his support for states determining their own laws for abortion so long as there are exceptions for rape, incest and life of the mother. "The states will determine by vote, or legislation, or perhaps both, and whatever they decide must be the law of the land – in this case, the law of the state," Trump said. Many states will be different. Many states will have a different number of weeks…at the end of the day it is all about the will of the people." Talking points. 1. Of ALL PEOPLE, Mister Moderate Mike Pence actually referred to LEGALLY ELECTED PRESIDENT TRUMP'S views as a "slap in the face" to the millions of pro-life Americans who voted for him. 2. Roe was BAD LAW, all the way around. I read the opinion and it was all over the place. And the word ABORTION does not appear in the United States Constitution. The ONLY reason the Supreme Court overturned it is because it was WRONG on the law and on the Constitution. 3. Overturning Roe does not mean a woman cannot murder her baby. It just means there is a time limit and the states get to decide on that time limit, (which is the way it is supposed to be.) 4. So far, ALL the DemoNazis had to run on (since they CAN'T run on the economy or foreign policy) is TRUMP BAD, ABORTION GOOD. The brilliant and LEGALLY ELECTED PRESIDENT TRUMP just took away that last card. 5. Those on the far right (which aren't that many in this country) want ALL abortions ended and outlawed, regardless of exceptions like rape, incest or saving the life of the mother. Those on the left (which include that minority of voters in this country known as the DemoNAZIS) believe abortion should be allowed even an hour after birth and paid for by tax dollars. LEGALLY ELECTED PRESIDENT TRUMP reflects the CENTRIST position of the vast majority of Americans.