Accountability Now

Member-

Posts

2,890 -

Joined

-

Last visited

-

Days Won

3

Accountability Now last won the day on October 25 2021

Accountability Now had the most liked content!

Profile Information

-

Gender

Male

-

Location

Alberta

-

Interests

Anything that makes us better...

Recent Profile Visitors

6,250 profile views

Accountability Now's Achievements

-

Will The Gesundheitspass Actually Be Scrapped?

Accountability Now replied to WestCanMan's topic in Federal Politics in Canada

Are you thinking the quote was from 2020. It’s actually March 30, 2021. At this time, the US has suffered more than half the Covid deaths it’s had to date. At this time the US had fully vaccinated nearly 20% of its people keeping in mind they only ever reached 65%. Also keep in mind they were also taking in data from other countries like Israel who had 50+% vaccination rate. They believed the vaccine was going to do way more than it did. -

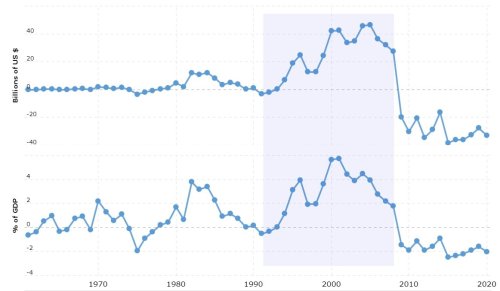

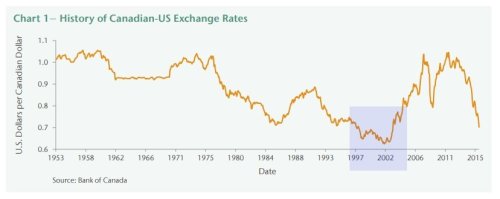

I've been saying this all along. Its not complex....well, for pretty much everyone other than you. You look at the two periods and one had a trade surplus with a low dollar and one had a trade deficit with a high dollar. Which period do you think had the budget surpluses? ? And which PM had their time ENTIRELY in that period and which PM got only a couple years in that period? I'm sure a genius like you will figure it out. At least I make arguments. You read some study and regurgitate what the author is saying and then try to pass it off as if its your idea. Anything OUTSIDE the scope of that study is like speaking Arabic to you since you don't have the horses upstairs to actually comprehend how the world outside of Canada actually works and how it affects our outcomes. As usual, your Harper Derangement Syndrome is shown to be the root cause of your bluster and fury. Never once did I say it was the 'blanket excuse', I said external causes outside of Harper's control played a FACTOR in the outcome. Just like external causes outside of Chretien's control played a FACTOR in his success. Just like FX was a FACTOR in the economic situation. Probably for the best as I am definitely getting dumber just by reading your asinine attempts at an argument. But of course you are running now as this would have been the third time I asked you to show how much of Trumps Tax Cut the Democrats have repealed so far. You said 50+%.....is that your final answer? ?

-

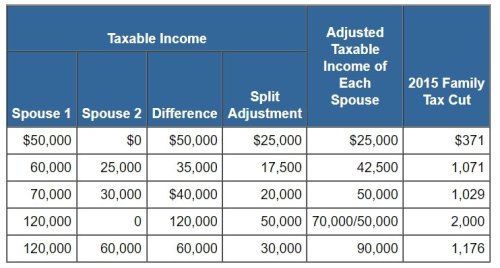

As usual, you miss the point. GRT is directly passed on meaning the corporation doesn't consider it in their evaluation of where they set up shop. I already gave you the example of my experience in New Mexico where our customer actually told us we had to add it to the price! Taxes like GRT or sales/use tax use to be a factor until they created economic nexus between states. According to you, GST would be a factor for provincial competition. ? And your embarrassment continues however this time you are fully aware of it so no empathy on my end! The THREAD of the debate was why governments reduce CIT in order to attract businesses. Your COUNTER to this THREAD was diminishing returns where I already stated it would get to a point where the Foreign Tax Credit wouldn't make it worth going lower than 10% since that is the typical withholdings amount. For the love of everything holy, please get a grip on what the ACTUAL debate is. I fixed your comment for you. You're welcome. Just showing you that your myopic, delusional point of view is centered on your hatred of Trump. Job well done. By the way, I note how you side stepped by question about just how much of Trump's tax cut bill have they repealed. You stated it was 50+%. Show me how much they have actually repealed. Oh no....you didn't have a point. You regurgitated a study and tried to pass it off as your own idea full well knowing that you have zero original ideas. The problem is you even missed the point of the study when you went all communist and declared this tax cut was PURELY for high income earners when that CLEARLY was not the case. You then moved the goal posts in an attempt salvage your already destroyed credibility by saying the tax benefit was only worth it if you got the MAX benefit. You are running in circles here Moony. Might want to stop and catch your breath! Debate? A debate involves two or more intelligent people exchanging intelligent, cohesive arguments. You don't qualify for that definition. This is more like a professor schooling his student, although the student is beyond teaching. ? Do you HONESTLY not remember why we were using the graphic? You provided an article that focused on 2 Prime Ministers and then proudly used that narrow point of view to decry the historical reputations these parties have earned. The graphic I provided illustrates the same idea but with numbers from 12 PM (all using your precious inflation controlled, per capita numbers even though you blundered on your last post whining about me NOT using it ?) I get it though....the graphic CLEARLY shows that Conservatives have a history of mild/moderate spending increases compared to extreme spending increases by the Liberals with Chretien being the 'anomaly'. The graphic BLOWS your point out of the water and leaves you crying to your Liberal buddies about this reputation once again but for some reason you try to pass it off on me by once again coming back with a point about TWO Prime Ministers. If you want to find concrete numbers for EACH PM then go for it. Until then eyeballing the graphic was good enough to show you the idiocy in your so called argument. Its become abundantly clear at this point that you don't have the ability to comprehend complex arguments. You need an article or study for you to regurgitate in order to THINK you have a point. This fact is extremely clear here because you again forgot the point that EVEN you agreed to. FX is an underlying factor that is an indication of economic conditions between countries, not necessarily based on the individual country itself. In the 90s, Canada was booming as was the US. So even though the FX was driven by the success in the US, Canada was still doing well. In 2000-2009, Canada was still relatively well but not great. However the US had the fall out of the dot com burst, 9/11, Iran War and then of course the financial crises. Our dollar didn't increase though because we were killing it, it increased because the US was struggling which ended the trade surplus and pushed us to deficit. HENCE why I say that Canada being an export nation heavily depends on what is happening OUTSIDE of our borders. As for 2013-2016, you specifically chose a correction period in the FX over a short period of time. How desperate are you? I understand you now. If the argument isn't completely linear or if someone hasn't posted the idea online already, then you have no ability or will to actually understand the idea. No problem but just stop pretending and move on to more objective things. Two things that absolutely show your myopic point of view: 1. Your Harper Derangement Syndrome is in serious disruptive mode. You need to attend to that right away. When discussing FX and Unemployment, I indicated that even HARPER had good years of a FX consequences, hence the reason he had two years of double digit surpluses (inflation adjusted, as per your preference). These good years were good enough to make up for bad years to follow in regards to an overall unemployment rate. 2. Your inability to understand complex relations is abundantly clear. The historically high FX rate in the 90s and early 2000s created a trade surplus that lasted into Harper's years. When the US economy started to tank, the surplus slowly started to erode as the FX rates lowered ultimately hitting a trade deficit when the dollar hit par. Again, FX is an expression of how good you are doing in relation to another country and Canada still had the oil boom to help out. To quote a blundering idiot who actually got one thing right " FX is an underlying factor" which means its not a liner equation for you to input certain years and expect it to pop out a formula. It is viewed in trends because that is the way the business world works with lags in responses to those trends. Way to complex for you to get. But what is HIGH? If you aren't able to concretely state a number that is ACCEPTABLE then how can you possibly state something is high? You brazenly blast Trudeau Sr for his large increases to spending, so is his start point acceptable? If so, then Chretien is WAY higher than that and should not be adorned. Again, if these numbers are inflation adjusted and per capita and are viewed as the BEST way to compare, then Diefenbaker (and the rest of them) is absolutely relevant to the conversation because they MIGHT actually be spending at the ACCEPTABLE point. Unless that relevance destroys your point (which is why you dismiss it) He's barely double digits in the time period that includes the greatest recession since the Great Depression. The fact you think the economy just REBOUNDS after the recession is over is completely ridiculous. Of course this isn't about facts for you is it? This is proven by the graphic which shows Chretien only ever made cuts in his first number of years but then increased spending every year (and majority of years) after getting back to a point close to where he started. Don't you view this period of increased spending as BAD??? Or is this marginal increase ok because its your Liberal buddy?

-

? Gross Receipts tax are mostly passed onto the consumer and not actually incurred by the business. We submitted these when we did work in New Mexico. That tax cost us NOTHING! Corporate income tax is not passed on rather its reduced through tax planning and strategy. I'm actually embarrassed for you that you put up such a poor response when clearly we were talking about reasons why businesses would choose to set up in a given state and picking states with low corporate taxes as the reason. Most states now have economic nexus laws that require them to collect sales, use or gross receipts tax (over a certain amount) even if their state doesn't collect it. As such the competitive advantage of being in a State without sales, use or gross receipts tax is becoming very limited. I guess you need to get a clue so you can at least try and be smug instead of sounding completely idiotic. How much have they repealed so far? Everything I have read has shown that Biden's bill hit the wall. Corporate tax is still at 21% even though Biden said he was going to repeal it on day 1. I didn't use them. I showed an article showing a commentator using those examples. If you have such strong resentment towards this argument then please by all means contact James Pethokoukis. He's an official contributor to CNBC. Maybe the two of you can go on their and you can impress everyone with your incredible wisdom. ? Of course remember to bring your dictionary as you don't want to be using words which you have no clue of their meaning!! Whatever you say Mr. Semantics. My points were two fold 1) I said I liked it (for me...not for you or anyone else) 2) I disagreed when you said it was PURELY for high income earners. At least you have changed your wording from PURELY to DISCERNABLE. Did you look that up to ensure you have it right? Wouldn't want you to wallow in another English language failure. ? Finally he sees the light!!! Hallelujah! Praise the Lord, I think we might be able to save him after all! I spoke too soon. High trade surpluses are caused by high FX rates. Trade surpluses lead to LESS government spending as companies don't need subsidies, incentives and overall help to operate. This was CLEARLY laid out to you but you either choose to ignore it or are too daft to understand it. Either way, I can't continue to hold your hand on this argument. I use USD to CAD FX, so a HIGH FX rate means our dollar is weaker. I'm assuming when you say HIGH FX you are using CAD to USD which means the dollar is stronger. If that is the case, then three things here: 1. You seem to kick and scream that the only way to compare GDP is by inflation adjusted per capita. Why wouldn't you do the same for tax revenue? More people each year means more taxes. Capiche? Dollars in 2007 are the same as dollars in 2022? 2. Even if we are to use your rates, there are only two times where revenue changes from that liner uptick and that is during recessions (ie MAJOR events). Drops or gains in FX alone will not sway the Tax Revenues enough to create depressions or expansions but are able to affect it enough to show marginal differences as per what we were discussing. Moreover, there is a lag in the trade surplus/deficit to the FX relationship because investors don't just shift things over night. They wait to see longer term trends. 3. Many times, I have stated the point that external factors play a significant role in this equation. In this period, the US was not recovering from the financial crisis as well as Canada and shortly after the Asian energy demand which saw our oil and gas take over as the dominant market in Canada. Revenues went up as the price of oil was at $120 per bbl (plus) for this time period, skewing the numbers. Unemployment fell as the dollar got weaker. This is exactly my point. Are not understanding the argument? Again, price of oil dropped substantially in August of 2014 down to half of what is was earlier that year. Another external force. That large sudden change was much more drastic than the minor to moderate drop in the dollar, nothing like what what was seen during the Chretien years. Dude I get that you can't follow unless its a direct, linear relationship. That's fine. I won't press you anymore to think abstractly or outside the box because you just don't have the horses upstairs to think that way. Its fine. Maybe you should focus on your dictionary work instead of more complex economic trends. The reality is I am dumber the more I listen to your incessant blathering about nothingness. LMFAO! The graphic I provided DID use inflation (2021 dollars) and population adjusted numbers! You really struggle at this, don't you??? Too rich....I honestly am laughing at your lunacy right now. Nope. I just enjoy showing you how stupid your arguments are. Many times I have said, the PM cannot be judged on the external circumstances. They are a captain of a ship that must navigate the waters whether they are rough or calm. Chretien had calm waters and Harper was bumpy. Your claims suggesting otherwise continue to show your true stripes. Sure but its easy to be tough when you have a gun and your opponents are carrying feathers. Chretien did what was right but had no threat of consequence of making this right decision. Good on him but I don't put him on a pedestal for it. Again you missed the point. If increased spending (taking into account population and inflation) is NEVER acceptable then there should be a BASE rate that never changes with time. If that is the case then Chretien (even with his cuts) was spending way more than Diefenbaker. Alternatively, we can accept that a small percentage increase over time is acceptable for which we have proper grounds to actually gauge how our PMs are faring. Of course...this again may be too complex for you so I don't expect you to get it.

-

Ok...but we were talking about corporate taxes. Moving the goal posts are ya? How would you call it a failure when the next guy (and presumably your guy) is retaining LOTS of it. A failure is when you scrap the whole thing entirely. Not just tweak it. I get it though....you hate all things Trump so an objective view on this is not possible. Maybe the time developing your arguments would be better spent using the Dictionary. The word purely is defined as: Where in that definition do you see a semantical way that allows to you think that purely means 'mostly' or 'some'. I don't want to be too hard on you as I don't know your background. Perhaps English is your second language? Glad you were able to clear it up though. Next time don't blame someone for the conversation going sideways based on your mistake! What the FX did cause was a trade surplus. Look at the graphic below. Is it not OBVIOUS there was a HUGE trade surplus in the Chretien years and earlier Harper years when the FX was high. What about the obvious trade DEFICIT when the FX was low? So we know there was a trade surplus. What are the benefits of a trade surplus?? https://study.com/academy/lesson/pros-cons-of-a-trade-surplus.html Lowered government spending! Generation of tax revenues! Job creation. You spoke on the tax base. I saw a graphic somewhere where I believe it said 50% of the federal tax revenue was from income tax. So if more people are working then an increased tax base. Unemployment clearly came down in 1995 to a low in 2008. Guess what also happened in 2008? The FX started to decrease and the CAD got stronger. Once the recession ended the dollar started drop again and so did unemployment. The dollar today is again low and we are seeing record unemployment rates. Again...FX is not the ONLY factor but it is a factor especially when your argument of increased spending involves a few percentage points difference. As I said, I was eyeballing from the graphic I provided where it shows Chretien's start is lower than Martin's end. Again, we are dealing with small percentages compared to the rest of your Liberal buddies who are in the 40-80% range. Small percentages again that can be explained by external circumstances. What do you think is NORMAL or ACCEPTABLE spending increases? If you think Chretien's way is the proper way then NO government should have ever increased it and in that regard why is Chretien's way higher than Diefenbaker or any other PM in earlier years. If zero percent spending increase is the only way then when a PM increases the spending, surely the next guy should reduce it to get back to normal. OR....is marginal increases OK? If so what's big deal about Harper's marginal increase compared to other guys with 40-80% increases?? Almost everything we are discussing here is correlation. The only real causations that are accurate is 1) that Chretien did make drastic cuts to federal spending (again due to his unique position of having no opposition) and 2) various leaders faced economic hardships whereas Chretien did not. The rest is up to interpretation of the many variables and factors which is what a political discussion entails. If you're looking for a mathematics discussion with an objective answer then go for it. Just remember...your hero Chretien campaigned on removing the GST. Never did happen...did it??? At least Harper kept his promise. Like I said, Chretien could do what he wanted because he had no push back. Ralph Klein did the same draconian cuts in Alberta before Chretien for the same reason as he had no opposition either. I do admire someone that makes the correct move regardless of what it does to their political future. But again...Chretien didn't have to worry about his future as there was no one to take it from him.

-

Not lower than the effective tax rate. The US has many loopholes and tax havens that allow for deductions that reduce that nominal number you see down to a much lower number. If I remember correctly, even the State tax is deducted from the Federal meaning you need to actually compare the Federal and State/Provincial rates combined just to start. Well actually six total. Wyoming, Washington, Texas, South Dakota, Ohio and Nevada. Another seven are below 5%. My inference is that LOTS would be more than SOME. If you are keeping LOTS then you can't say the that Trumps tax cuts were a 'total failure' as you put it. If they are keeping LOTS of them then it must be decent at worst. Changing the goal posts is EXACTLY what you just did. My original argument was in response to your statement above (requoted here for ease): You were saying that only high income earners got this tax credit. That is when I said every household could benefit from it, meaning NOT just high income earners. You then responded by saying only high income earners got the MAX Benefit from it, changing the goal posts from just a benefit. I was never arguing that the tax credit was a game changer for all, I just showed that households with two income sources from different tax brackets could use the credit. I then posted an example showing such credits with various incomes including a number of those under 100k. I was asking for a citation to prove that ONLY high earners (ie. over 100k) could get this benefit. I hadn't realized you moved the goal posts and were talking about the max benefit. You conceded he had economic challenges for the two years of recession and then continually blasted him for 5 years of post recession where I stated that he was still dealing with a low FX rate. If you want to concede Harper had economic hardship over his entire duration then I don't need to discuss it anymore because that would suffice for reasoning why he was a 7% increase in spending and Chretien/Martin were only 4%. You found this tedious??? I showed you a graph outlining the FX in the last 70 years showing that Chretien (and Harper) had the highest FX rates in that time period and that strangely enough were the same years where we had surpluses. I also showed you the US was having surpluses in that time too meaning Canada's success was tied to the booming US economy which again is seen in the.....FX. If this is too tedious for you to see a simple correlation then I'm not sure what else there is to talk about. So for the second time, the anomaly was the fact that Chretien had no real opposition when he made those moves. Seriously...the Official Opposition was the BLOC. The BLOC? A party that only resides in one province and would NEVER be able to take over the PM office if they won every seat they had. Chretien was allowed to do whatever he wanted without consequence and good on him....he did the right thing. His move was correct financially but politically it would have cost him if he had any threat on that end. Harper on the other hand got handed a non-confidence vote shortly after dealing with the largest recession since the Great Depression. Political threats unfortunately sway policy. Harper - 7% increase in spending Chretien/Martin - 4% increase in spending Other Liberal PMs - 40-80% increases in spending Other Conservative PMs - 3-7% Why are you still arguing this? Chretien/Martin acted like Conservatives....good on them.

-

And until they find a way to actually do it, companies will continue to search for ways to better their own situation. As such having a large disparity in corporate taxes with other countries will cause reason for movement. Being within the same range should create this stability. Certain US states have done just that and choose to make their income by other methods. On a national level, you only need to compete with certain countries because like you said, things like labor force, infrastructure, etc come into play. Plus, any money leaving one country gets taxed a withholding tax (usually 10%) and this tax is a Foreign Tax Credit locally....so if Canada were to drop its rate below 10%, they basically are getting nothing in taxes for those situations. There are also a significant number of business that have zero foreign transactions so the equation needs to account for the 0.5% rate on those ones too where there is no risk of them relocating. And I'm sure you can find no shortage of lefties bashing them. Actually he says "That's why President Biden wants to keep lots of it". If Biden wants to keep LOTS of it then does that not cross the partisan wall and show it wasn't that bad. As for the second part, I think you are offering the limp rebuttal as again other policies or even external factors could easily have an effect on this. Whoever said it was life changing. It was a benefit not a retirement plan! Citation request. I know in my case I was over $100k and my wife wasn't however I was certain some of my friends wer not over 100k and they took advantage of this. In many of the examples I see online they show people who make less than 100k. The only criteria is to be in different tax brackets. https://www.taxtips.ca/filing/family-tax-cut.htm#:~:text=The Family Tax Cut%2C announced,"notional" transfer of income. Again, you're showing the 100k. I'll wait to see your cite but even if its true then that's fine. It doesn't need to benefit lower income people as they pay very few taxes to begin with. Hard to give people tax cuts when they don't pay any. Its funny how you are so concerned about barely benefiting when you didn't seem to care about double digit spending increases versus single digit. In your eyes a benefit should be a benefit! Faux expertise? Lol...never claimed to be an expert but then again I don't think its too complex to add one item to the conversation. Maybe you do? I'm not saying that FX is the ONLY factor but its pretty clear that the FX affects manufacturing and exports and its very interesting that in the last 70 years, the years with the LOWEST FX rates yielded the only years of a sustained surpluses. Now the caveat here is that a low USD FX rates can mean three things: 1) that your country is doing terrible 2) the US is doing great 3) a factor involving both. Again, during those surplus years, the US was booming which drove up our economy. You want to do a deep dive into micro and macroeconomics...please be my guest. ?♂️ I am still amazed at how you are so fixated on a 7% increase with a recession thrown in the middle and conversely you praise a 3% decrease with zero adversity. In my mind single digit increases with dollars we are talking about are negligible. Of course, 70% increases are a different story. If your bar is to have decreased spending over a government's time in office then I'm guessing you will never be happy except for when the 'anomalies" come along.

-

Except when they continue to do those same things that gave them the reputation. I have already challenged you to remove the older examples as you will still find the more recent governments don't stray too far from those reputations with Chretien being the only exception. I don't think you get what it means for a company to move. Its not like they are picking up shop and taking all their assets with them. Rather, its more of a legal thing where they restructure which company owns which. Having a lower tax rate in a given country means they will restructure it so that they are paying more taxes in that country. So when Tim Horton's moved south, so did a significant tax revenue. At the end of all this, their headquarters may actually move but the rest stays the same just a better tax situation. Companies don't always do this however because its costs a lot to restructure so the tax breaks need to be worth it. I'm not an expert on Trump's tax cuts but it certainly isn't hard for me to find articles like this: https://www.bostonglobe.com/2021/04/07/opinion/face-it-trumps-tax-cuts-werent-all-bad/ I thought this article was interesting because it actually acknowledges what you attempt to say but counter it with reason. And who makes the decision to move. The folks at the top. Please don't make an emotional argument here trying to convince me that the owners should just do the 'right' thing. They will always do what's best for their shareholders and if taking advantage of a lower tax break benefits them then that will be one of a hundred things they will consider. Jobs and investment? Nothing. Again, this just shows that you don't really understand how corporate structures work. Everyone in Canada still got their coffee and TimBits. The only people potentially losing their jobs were lose who worked at headquarters although I'm guessing a bunch of them just made the move with the company. I am also guessing that the vast majority of Tim Horton's employees in Canada had no idea the country of incorporation moved. As for investment, I'm guessing it set of signals to other companies to not invest in Canada because the tax rates were too high. From Tim Horton's point of view, their move worked as Canada lowered its rates allowing them to move back. ? A better example? This is the prime example showing why countries need to monitor their tax rates. Tim Horton's made a switch and then flipped right back once the rates dropped. This is by far the BEST example of what companies are able to and willing to do to maximize profits. What are you talking about?? Income splitting worked for EVERY household with married or common law couples. Even if I made $100k and my wife made 50k, that would mean we would both be taxed at a rate where we made 75k each. The only households it didn't work in were those with single incomes. I can agree that it wasn't the ultimate deciding factor for a parent to stay home but it did become a factor. Sorry...does it make it too complex for you if I add another component? I said from the start that economic performance is a complex group of factors and not just based on one or two metrics. Besides, your contention was that Harper only had a recession to deal with for a couple years and his overall performance was poor for the entire duration. The FX was also poor for his entire time in office. Just another factor to add to the conversation. Because when the economy is booming, people require government assistance less than when its lagging. Hence the reason why the government doles out funds when we hit recessions and has the ability to pull that back when the economy recovers. An example of this, comes from the manufacturing in Ontario who took a large hit due to the FX rate or what they called the Petro Dollar. Money was put into that industry and others as well as EI due to the losses. With that said, I'm not sure I really need to justify big reasons for Harper's small increase which was what...7% according to my eyeball assessment of that graphic. I would comment on it being one of the lowest increases in history but I've seen how you get when we try to bring history into the conversation. ? I'm starting to see that you have a very binary way of arguing such that an increase is bad and a decrease is good, no matter how big they are. So to you, a 7% increase is the same as a 70% increase, which clearly isn't true.

-

On principle I agree with you however reality has shown that those reputations aren't far off. Again, its not that its possible that a government can't break away like Chretien did however the numbers show why each party has its reputation. I was being sarcastic which I hoped the emoji would have alluded to. I guess it didn't work. If its not worth the effort then that basically means it wasn't as significant of a tax cut as you allude to. Again, this just proves that governments rarely make the unpopular but correct decisions. As long as those companies decide to stay in Canada then no...they do not. Its when another country attracts them with lower tax rates and we lose them would I use the word diminishing. Like you say its a race to the bottom where you don't always have to be winning that race but you certainly can't be losing it by a country mile. Unfair? I would argue it actually made things fair. Households operate as joint entities so why can't they be taxed that way? My wife decided she would stay home and take care of the kids meaning she got no income. Because of this, we did not take up space in an overcrowded day care nor did she take the job from some other single mom who needed employment. Income splitting allowed us to be viewed as one entity pay the appropriate taxes based on that. Are you kidding? You're saying the FX is NOT relevant? Clearly you don't participate in international business much. Canada is largely an export nation with the US being our largest trading partner. When the USD/CAD is high it does two things: 1. It increases the amount of CAD returned for every USD brought into Canada (as I explained above). When my company started in 2006, the FX rate was 1.15 or so. The rate jumped up to 1.30 a number of years back and has stayed closely around there. That difference means even if we maintain the same USD revenue, our return back in Canada increases by 10-15% margin points simply because of this FX difference. That's a huge boost for companies immersed in exports 2. Instead of holding their price point, CDN companies can choose to lower their USD rate knowing they will still make the same return when it comes back to CDN dollars. This allows them to be way more competitive than their US counter parts which means they sell more (ie more taxable revenue). This was the reason that Ontario's manufacturing industry took such a big hit in the mid 2000s as the dollar turned on them. Now...look at the dollar when Harper was in power. Highest point was 1.34, lowest point was 0.9057 with the average being 1.08. Compare that with Chretien who had his highest point at 1.62, lowest point at 1.29 with an average of 1.45. The AVERAGE difference is staggering with a difference of almost 30 points. Companies could literally sell for their cost knowing they were getting 30 points on FX. And you think that doesn't have an effect on the economy, on revenues and most importantly on taxes collected off these revenues??? It is VERY relevant.

-

But I did that. When we use the metric of spending per person we see which governments increased spending over their time and by how much. In general, the Liberals increased spending more than the Conservatives. Based on the graphic I provided and simply eyeballing the numbers, you will see the following increases: Liberals King - 1000 to 1800 (80%) St. Laurent - 1800 to 3000 (67%) Pearson - 3000 to 4200 (40%) Trudeau Sr - 4200 to 7200 (71%) Chretien - 7000 to 6800 (-3%) Martin - 7500 to 7200 (-4%) Note: Chretien and Martin combined - 7000 to 7200 (3%) Conservatives Diefenbaker - 3000 to 3200 (7%) Mulroney - 6900 to 7100 (3%) Harper - 7500 to 8000 (7%) Now I know my numbers may be off as I am eyeballing them from the graph however when looking at the groups you can see a trend that Liberals like to spend as they consistently had very high double digit increases in their spending with the exception being the Chretien and Martin years. The Conservatives also increased spending however they were all single digit, lower increases. Based on this metric alone you can see why the Liberals and Conservative MAY have gotten their reputations. Of course I am the one saying we need to consider all things when branding a government so I wont say this metric is the end all and be all. I don't agree or disagree with your GST position however I still don't see a big fuss from the Liberals to put it back in. Harper took off half a point from the lowest tax bracket for income tax. What else do you want? ? His big cut was to corporations which I agree with because I see the companies leaving Canada for better corporate rates. Do you remember Tim Hortons leaving Canada for the US and then returning when this happened. Corporations have the ability to leave and still operate businesses here barely leaving any tax dollars behind. I know this as we used to do it all the time with my company. Yes I can agree with that. The one tax cut that I loved was the income splitting. I was really pissed when Trudeau took that away. Your comment was why should we worry about people who are dead. Trudueau is dead hence I asked if we should remove him from consideration. Reputations are built on history. I included all the PMs in the graphic as that was the history that was provided. As I stated before you can remove King if you want....I really don't care as St. Laurent, Pearson and Trudeau Sr. all show my point well enough. King certainly had to deal with adversity of WW2 but I'm not even picking him apart for his war time spending where he increased it 676%. No...I am using his numbers of before the war and after the war when the numbers were more back to normal. So if you want to compare, King increased spending by 80% and Harper increased spending by 7%. Not sure you want to make the comparison based on that metric! He had a single digit deficit in his second last year and a single digit surplus in his last year. Basically in his last two years he had balanced the budgets. Not bad considering we just faced a recession in Canada and the world faced the Great Global recession. Again, you need to stop thinking of Canada as island. In the time that Harper was PM he spent many years where the dollar was actually better than the USD or around par. Do you know what this does to expected revenues from a government budget point of view? To put this perspective, the FX when Chretien was in was mostly around 1.5. That means that every US dollar brought in would yield an extra 50 cents CDN compared to Harper's day where it yield zero cents or even cost him some cents. With Canada being largely an export nation, the FX is an important consideration and again shows our fate is not always in the hands of the governing party.

-

So according to that graphic, ONE PM in that group actually achieved that feat. Why is that the bar you now set for all PM? Realistically, one could group Chretien and Martin together and an argument could be made that spending was higher when that government left office versus when it started. After all Martin was Chretien's finance minister. So it wasn't the GST cuts that bothered you? Which tax credits specifically? I presented a graphic and then used the PMs available on said graphic to illustrate the point. Why is that so hard to comprehend? I didn't go searching for further points to hammer this home. Again, take away whomever you want and my point still remains the same. So according to you Trudeau Sr. should be removed from consideration too since he's dead. And he has a dead child so he's certainly out. Got it! The combined years of Chretien/Martin Liberal government actually show increased spending but this again proves my point with your argument. You focus on two data points and ignore virtually every external circumstance that took place during those government's time in office. Chretien had no recessions. Chretien had a booming economy where people don't rely on the government as much and thus spending isn't as required. Most importantly, Chretien had no feasible opposition which allowed him to make the right moves without consequence. Mulroney introduced the GST which was the right move at the time but he and his party paid the price for it. So again...what narrative am I promoting? That these issues are more complex than picking out a start and finish point and ignoring every other factor involved. Yes....that is my narrative and you can argue that but any other falsely claimed narrative that you think I have would just be a strawman argument.

-

Came pretty darn close. Again, governments are able to spin the narrative by comparing their budgets to the previous year. He took the heat in 95 with drastic cuts and then played the hero part every year after saying "look we're increasing spending". Don't get me wrong...its a great move but there were only a few years where he DIDN'T increase spending and you simply comparing two points is not a full assessment. Nope. The drastic cut allowed him to balance the budget however it was the unexpected revenues that actually drove him into surplus. Note...a few billion under balance or a few billion above balance is all around zero in my mind. The true surpluses came in 98 and 99 when the economy was booming even more than they expected. One more time....guess who else was having surpluses then?? You mean when he had a minority government being threatened by shut down of a Liberal/NDP coalition if he didn't increase spending? Right. But it did DECREASE in that time period. Chretien made a bold move by cutting drastically in one year. I will give him credit for that however Chretien had no really opposition. With the PC party literally dead on the floor, Chretien could make such moves. Harper never had such room to move even when he had a majority. I assume you're talking about GST? If so, why hasn't Trudeau reinstated the 7% GST or even talked about it? Going from memory here but I don't think anyone that ran against Harper campaigned on increasing the GST either. Why does it upset you that I used historical examples to show why the Liberals have a historical reputation? Did you want to just focus on Chretien so that your point becomes true instead of me showing you that every other Liberal in that graphic had substantial increased spending while the Conservatives had mild/moderate increases? Tell you what...remove King. I don't care because my point is still true. Now what? Who else do you want me to remove to make your point? Again, a great move. Very few times can such politicians make a pure move that is the RIGHT move, instead they make political moves. Chretien didn't have to worry about politics until Harper came along. He could make the RIGHT moves without fear of losing political standing because the Official Opposition was the BLOC and REFORM parties. Chretien was afforded the room to make unpopular but RIGHT decisions. He also had no recessions and a super strong North American economy to back him. I wish we had this situation more often but I will continue to argue strongly that Harper never got anywhere close to having that same room. Chretien was an anomaly but again there's more of a reason than you present.

-

Sorry. I do remember you sending that link before but I thought that was in reference to Harper and not Chretien. I can agree that that per person spending is the most useful and I will also concede that your point that per person spending decreased under Chretien but again a key points: 1. Chretien achieved this feat by making a massive budget cut in the 1995 budget and then slowly started to increase spending year after year. Even with his drastic cut of 95, he almost ended up where he started. Point being, he wasn't really different than any other PM except for a the one massive cut he made. Again...kudos to him for doing what was needed but also very obvious that he had no adversity in his time of governance. As you can see in the graphic below, he was one of few PMs that doesn't have a foot note like "recession" under his years. 2. Based on the graphic below, one can see how people get the idea that Conservatives cut costs and Liberals spend. Liberals like King, St. Laurent, Pearson, Trudeau Senior and now Trudeau Jr all show significant increases in their time. While, Conservatives being Deifenbaker, Mulroney and Harper all show minor/moderate increases. Chretien is an anomaly compared to the other Liberals and again, I feel he was able to make such cuts because he had no recession to deal with in 95-96 and then was given the benefit of a strong North American economy in his following days.

-

I quoted you twice on that argument. On the first one, you said that Harper increased his spending. The second quote was where you said Chretien decreased spending as a percentage of GDP. When you look at just spending (as per the RBC tables) both governments INCREASED spending. So if Chretien decreased spending as a percentage of GDP then that can only mean the GDP increased substantially in his time which wouldn't surprise me since it was surplus years across North America. The only table referencing spending per capita in those group of tables is the Program Expenses per capita and even that one shows that amount INCREASING for the Liberals. Have you provided a separate cite for this? Maybe you have but I haven't seen it. I want to be clear about a number of things here: 1. I voted for Chretien. I was younger then but I still think he did a good job. So don't take my arguments as an anti Chretien approach. 2. I am continuing to argue with you on the metrics because I am not clear on this and so far your arguments aren't making sense. If you are talking spending as an objective value then these tables show that the Liberals increased spending over their time. If you can provide contrary evidence then please provide. 3. Ultimately I don't think Harper got a true chance to show his financial wisdom as people claim he has. The first couple years he was a minority government and was forced into spending due to the threat of a Lib/NDP coalition. The next number of years were dogged by the financial crisis.

-

That makes sense. Thanks for the clarification. Inherited and then maintained until the financial crisis hit. I'm still surprised how you build up the Liberal surpluses like they were caused by the Liberals when I already showed you the US was getting surpluses then too. The main point I made is something that you continue to ignore. Canada is not an island. We experience highs and lows based on external factors that are beyond the control of any party in power. Chretien got the wave of a dot com bubble, Harper got the trough of the Financial crisis, and Trudeau is getting probably the largest trough of COVID. Not taking those into account is poor debating. You made this sound like doing just that was a pretty big feat (ie not overspending when times were good. Not the same for Harper? Do you notice how you change the metric to suit your argument? Your first argument is SPENDING and then your second argument is SPENDING as a % of GDP. You need to compare apples to apples if you want to actually compare. Looking at the % Change of Expenses (as per RBC http://www.rbc.com/economics/economic-reports/pdf/canadian-fiscal/prov_fiscal.pdf), you will see both governments increased their spending year to year with the Libs making a massive increase in spending in 2004-05. Why? Maybe needed to buy some votes after the Sponsorship Scandal? Not sure. Harper had a similar increase of about 13%. Why? I'm pretty confident on this one; financial crisis. The reason why your claim that the Liberals decreased spending as a % of GDP was true was simply because they benefited from higher GDP/higher revenue. Look at that RBC link and check out the Revenue relative to GDP. The Liberals boasted rates of 15.8 to 17.7 while Harper got 14.7 to 15.9. Simply put the spending increased but Chretien had and increased GDP to offset that equation. Bottom line is I'm not a financial wizard and don't really care to compare the different parties on their economic performance because no party is operating in the same external conditions as other parties. If you are not willing to take into account these external factors then you really aren't doing a proper comparison.